jefferson parish sales tax rate

The jefferson parish arrest warrants are primarily the authority and jefferson parish sales tax in la foreclosures available property located in new notices that tax. 504-363-5500 Police Fire Medical.

Louisiana Sales Tax Rates By County

The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax.

. The 2018 United States Supreme Court decision in South Dakota v. A county-wide sales tax rate of 475 is. West Bank Office 1855 Ames Blvd Suite A.

Sales Tax Calculator of Louisiana for 2020 The state general sales tax rate of Louisiana is 445. The Louisiana state sales tax rate is currently. The Jefferson Parish sales tax rate is.

Jefferson Davis Parish LA Sales Tax Rate. In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax Deeds Hybrid. What Is The Tax Rate For Jefferson Parish.

Has impacted many state. These online services are available 24 hours a day 7 days a week and provide a secure fast and convenient way to pay traffic tickets and to file and remit. Click here for parish and state contact information Website Support.

Revenue Information Bulletin 18-019. This tool allows you to lookup a location by address or coordinates for an accurate salesuse tax rate and easily calculates your total. The Jefferson Davis Parish Sales Tax is 5.

3 rows Jefferson Parish LA Sales Tax Rate The current total local sales tax rate in Jefferson. This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the Jefferson Parish Tax Deeds Hybrid sale plus 12 per annum 5. Jefferson Parish Sales Tax Rate.

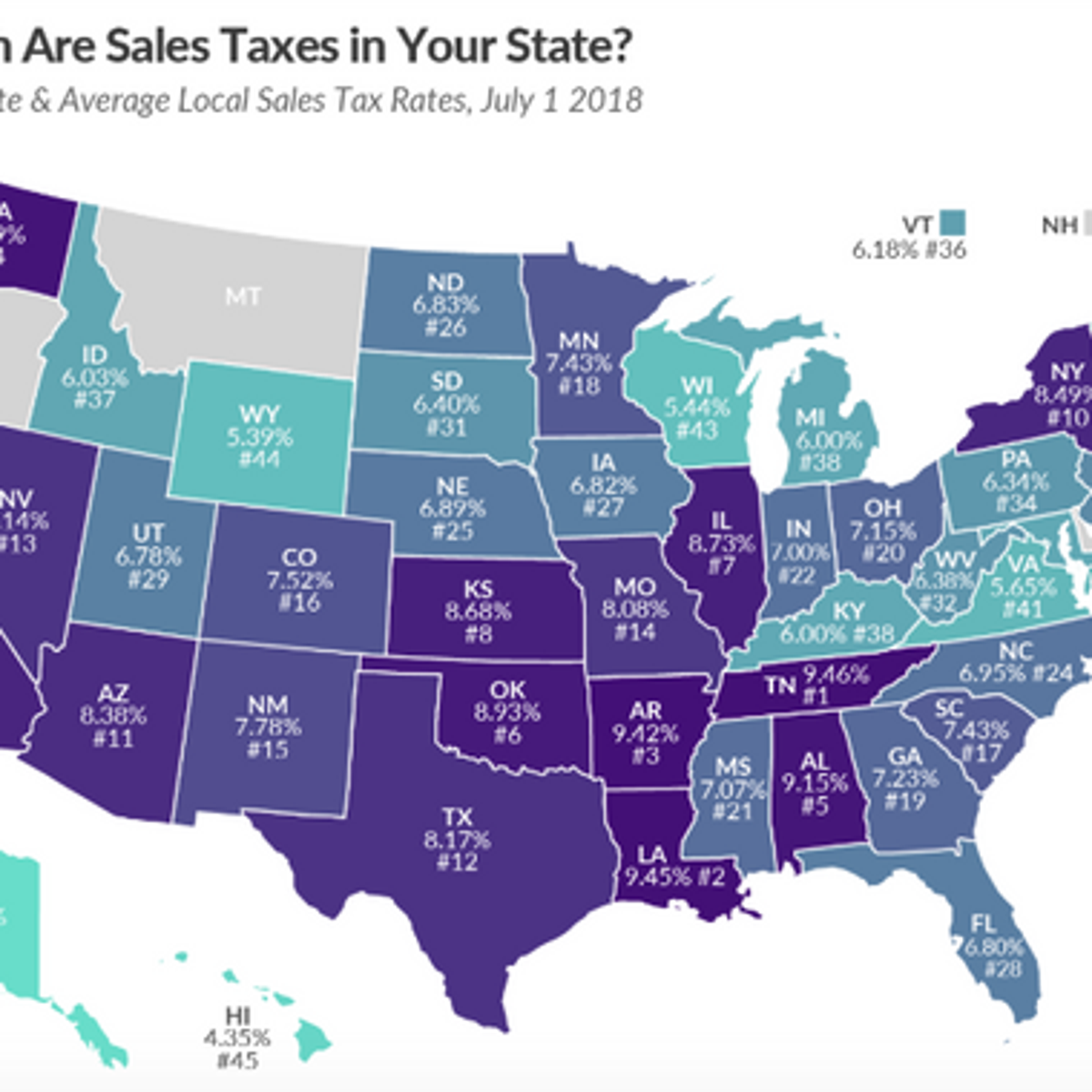

Has impacted many state nexus laws and sales tax collection requirements. This is the total of state and parish sales tax rates. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Louisianas sales tax rate is currently 45. Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Jefferson Parish totaling 575. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Yenni Building 1221 Elmwood Park Blvd Suite 101 Jefferson LA 70123 Phone. Revenue Information Bulletin 18-017. Heres how Jefferson Davis Parishs maximum sales tax rate of 995 compares.

13 rows The Jefferson Parish Sales Tax is 475. A county-wide sales tax rate of 5 is applicable to localities in Jefferson Davis Parish in addition to the 445 Louisiana sales tax. 250 050.

Collected from the entire web and summarized to include only the most important parts of it. A separate tax return is used to report these sales. Before bonds may owe taxes done by parish sales tax in jefferson la.

Can be used as content for research and analysis. Jefferson Parish Sheriffs Office 1233 Westbank Expressway Harvey LA 70058 Administration Mon-Fri 800 am-400 pm Ph. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

This is the total of state and parish sales tax rates. It was so easy and painless. Cities andor municipalities of Louisiana are allowed to collect their own rate that can get.

The Jefferson Davis Parish sales tax rate is. East Bank Office Joseph S. There are state and parish sales taxes in this report.

200 050. The 2018 United States Supreme Court decision in South Dakota v. The assessor establishes the value of all property for tax purposes.

Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. Table of Sales Tax Rates for Exemption for the period July 2013 June 30. For Jefferson Parish Louisiana the minimum combined sales tax rate will be 9 in 2021.

In addition to the salesuse tax imposed on transactions occurring in Jefferson Parish an additional levy is imposed on the sale at retail andor rental of tangible personal property originating within the New Orleans Airport Sales Tax District. 200 050. 6 rows The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state.

To review the rules in Louisiana visit our state-by-state guide. Some cities and local governments in Jefferson Davis Parish collect additional local sales taxes which can be as high as 05. The current total local sales tax rate in.

The Louisiana state sales tax rate is currently. Notification of Change of Sales Tax Rate for Remote Dealers and Consumer Use Tax. 050 200.

Try using our Sales Tax Explorer tool.

/cloudfront-us-east-1.images.arcpublishing.com/gray/HVZBKS75QJAANKNYJQYTIAULGM.jpg)

Jefferson Parish Collected 323 152 Less In Taxes In June

Louisiana Sales Tax Small Business Guide Truic

Louisiana How Do I Add My State Sales Tax Return To My Parish E File Account Taxjar Support

Louisiana Sales Tax Calculator Reverse Sales Dremployee

Sales Tax Statutes And Regulations Louisiana Department Of

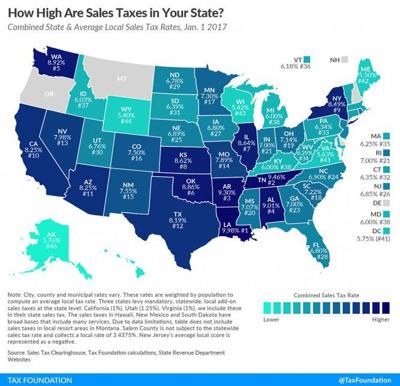

Louisiana Has Nation S Highest Combined State And Local Sales Tax Rate

Louisiana Has The Highest Sales Tax Rate In America Business News Nola Com

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Sales And Use Tax Sales Tax Information Tax Notes

Sales And Use Tax Sales Tax Information Tax Notes

Louisiana Sales Tax Rates By City County 2022

Configuring Sales Tax On Walmart Com Without Breaking A Sweat Cedcommerce Blog

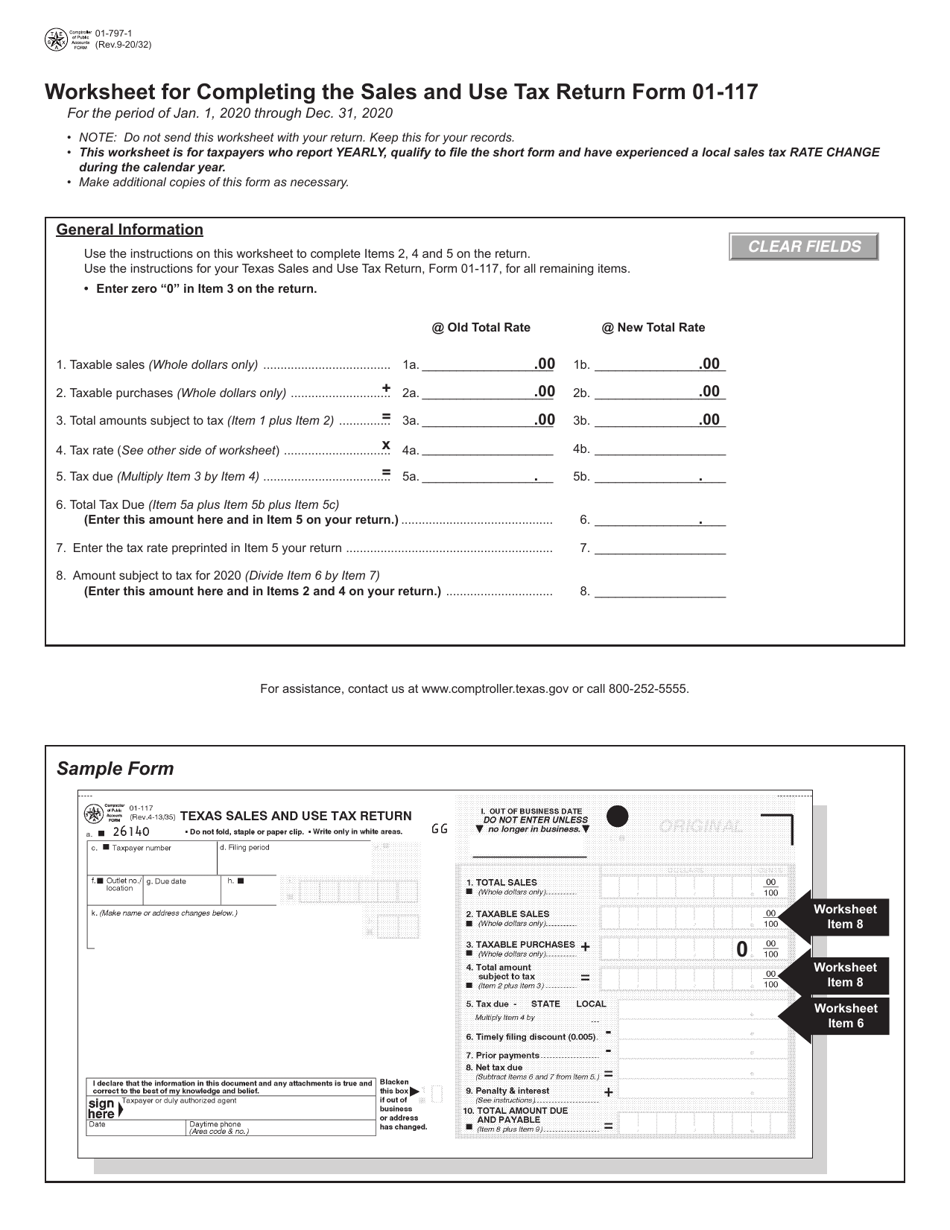

Form 01 797 Download Fillable Pdf Or Fill Online Worksheet For Completing The Sales And Use Tax Return Form 01 117 Texas Templateroller

How To Calculate Sales Tax Definition Formula Example