michigan use tax exemptions

In Michigan certain items may be exempt from the sales. They are also exempt from sales tax on the Fixed Charge if they have no use.

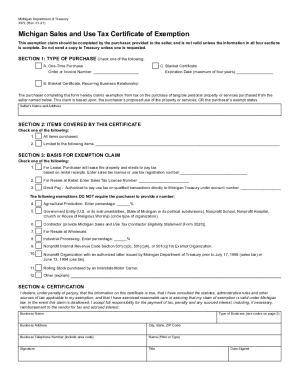

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Commercial businesses in Michigan are tax-exempt for natural gas used in agricultural production.

. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services. Use tax is also. Outside of these types of.

Sales and Use Tax Exemption for Transformational Brownfield Plans. Ad Avalara Consumer Use Reconciles Transactions and Automates Your Use Tax Compliance. Department of Treasury holding that the Michigan Use Tax apportionment rules apply in situations where property is simultaneously used for exempt and non-exempt.

Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing. Some of these exempt businesses include churches schools wholesalers resale retailers government 501c3 and 501c4 organizations and more. All fields must be.

Use tax is also. However if provided to the purchaser in electronic. The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate.

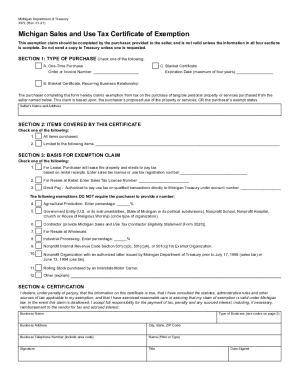

Ad Avalara Consumer Use Reconciles Transactions and Automates Your Use Tax Compliance. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. Church Government Entity Nonprot School or Nonprot.

Minimum 6 maximum 15000 per. Several examples of exceptions to this tax are vehicles. Legislation enacted in 2016 created an exemption from sales and use tax on purchases of tangible personal property affixed to and made a structural part of county long.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. 2017 Sales Use and Withholding Taxes Amended MonthlyQuarterly Return. The Leading Online Publisher of National and State-specific Legal Documents.

The only exemptions provided under the Sales and Use Tax Acts for contractors purchasing materials is. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable rentals.

The following exemptions DO NOT require the purchaser to provide a number. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax. Sales Tax Exemptions in Michigan.

How do I claim a valid exemption with my supplier. Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax. Use tax of 6 percent must be paid on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases by mail from out-of-state retailers.

A purchaser who claims exemption for resale at. An on-time discount of 05 percent on the first 4 percent of the tax. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus. The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals. For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425 percent and the personal exemption is 4900 for each taxpayer and dependent.

2017 Sales Use and Withholding Payment Voucher. As of March 2019 the Michigan Department of Treasury offers. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on.

Avalara Consumer Use Offers A Smarter Easier Solution For Automating Use Tax. Michigan defines industrial processing as the activity of converting or. There are no local sales taxes in the state of Michigan.

Thursday June 10 2021. 2017 Sales Use and Withholding. Michigan Sales and Use Tax Certificate of Exemption Form 3372 Multistate Tax Commissions Uniform Sales and Use Tax Certificate.

When the 6 sales tax has already been paid upon the retail sale of property to a customer that personal property is exempt from use tax being paid by the customer.

Michigan Sales Tax Small Business Guide Truic

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Mi Dot 3372 2021 2022 Fill Out Tax Template Online Us Legal Forms

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Download Policy Brief Template 40 Words Word Families Word Template

States Sales Taxes On Software Tax Software Software Sales Marketing Software

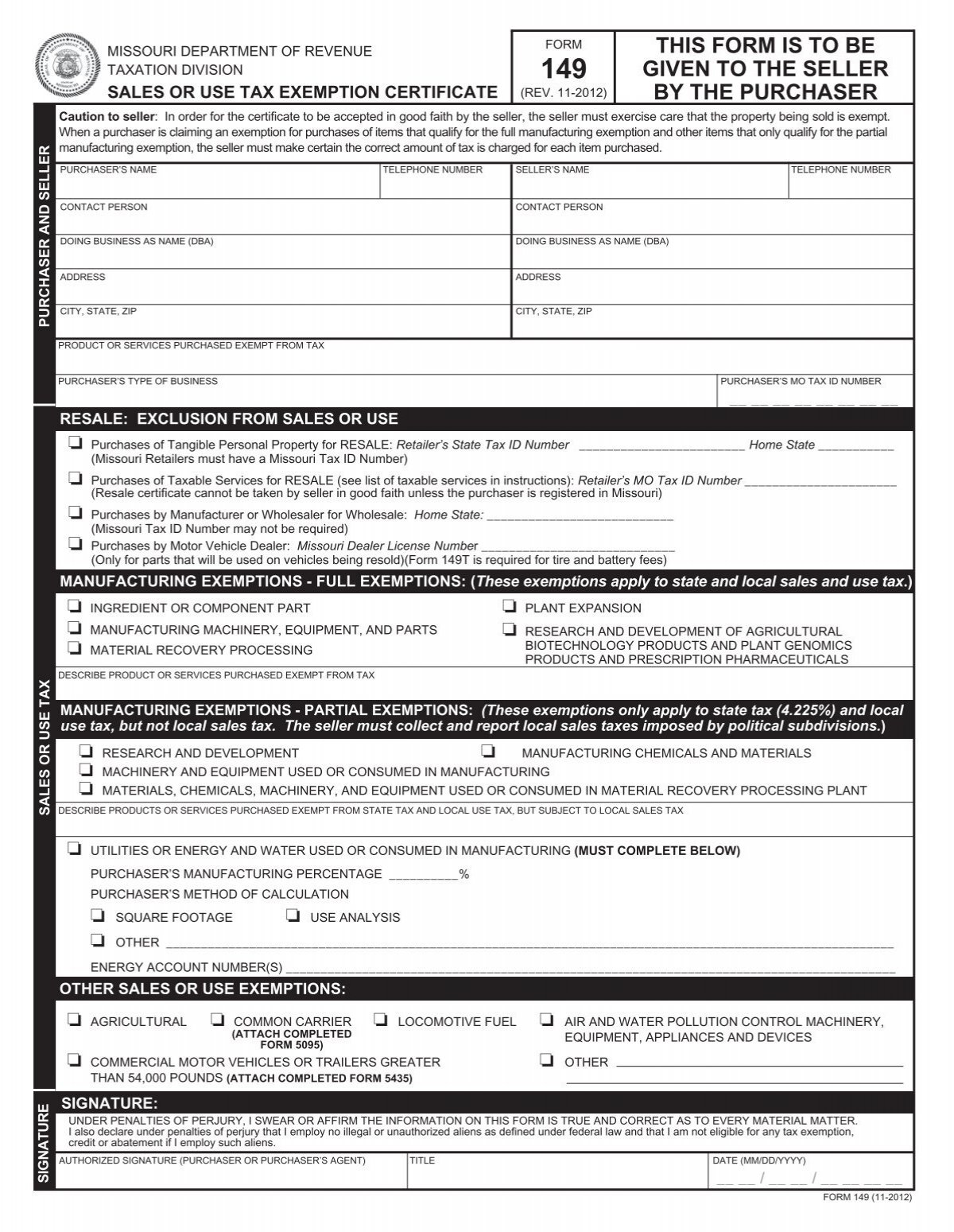

Form 149 Sales And Use Tax Exemption Certificate Missouri

Michigan Sales Tax Exemption For Manufacturing

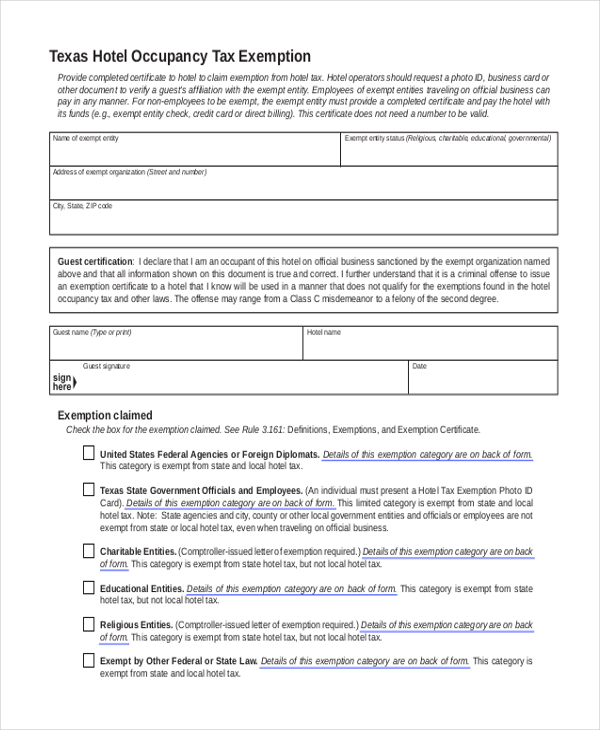

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Sales Tax Exemptions Agile Consulting Group

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Sales Tax Exemption For Building Materials Used In State Construction Projects

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemptions Agile Consulting Group

Download Policy Brief Template 40 Brief Ms Word Executive Summary

Sales And Use Tax Regulations Article 3

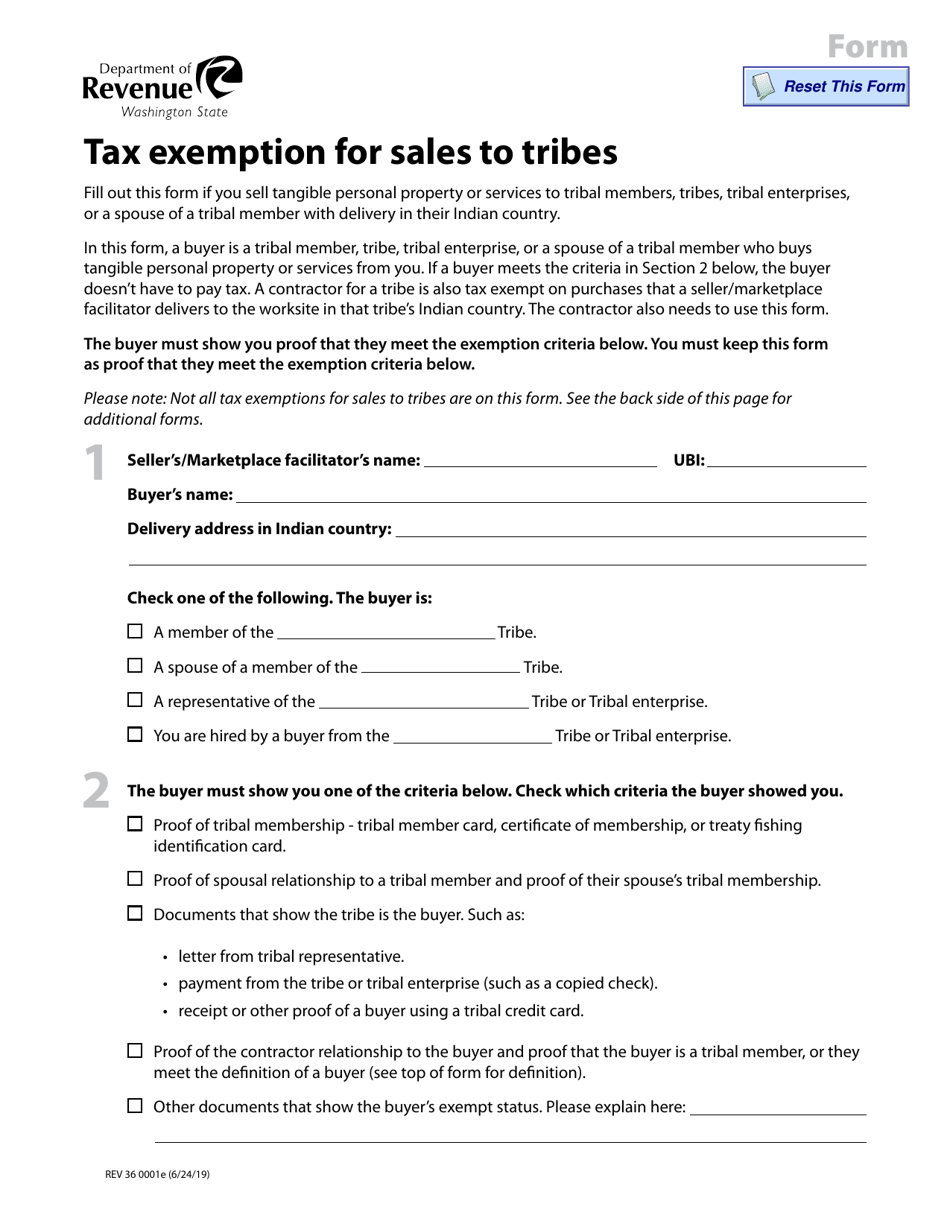

Form Rev36 0001e Download Fillable Pdf Or Fill Online Tax Exemption For Sales To Tribes Washington Templateroller

Michigan Bill Would Allow Expecting Parents To Claim Fetuses As Income Tax Exemptions Tax Preparation Free Workout Routines Tax Deductions

Resale Certificate Michigan Fill Out And Sign Printable Pdf Template Signnow